FTSE 100 CEO and CFO “churn” reaches post financial crisis peak

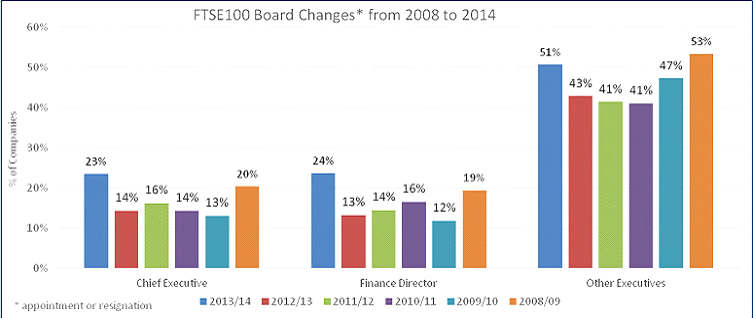

“Churn” (the percentage replaced in a year) among FTSE 100 Chief Executives (CEOs) and Finance Directors (CFOs) has reached a level not seen since the beginning of the financial crisis, according to new analysis by KPMG in the UK. KPMG’s research, which forms part of the firm’s annual Guide to Directors’ Remuneration, reveals that churn among FTSE 100 CEOs was 23 percent in 2013/14, up from 14 percent the previous year and the highest since before the financial crisis began. For FTSE 100 FDs, this year’s churn and increase in churn was even higher: 24 percent up from 13 percent the preceding year. Indeed, according to KPMG’s analysis, in the last year, over half of the board rooms in the FTSE 100 experienced at least one change of executive director, the highest proportion in the last five years.

“Churn” (the percentage replaced in a year) among FTSE 100 Chief Executives (CEOs) and Finance Directors (CFOs) has reached a level not seen since the beginning of the financial crisis, according to new analysis by KPMG in the UK. KPMG’s research, which forms part of the firm’s annual Guide to Directors’ Remuneration, reveals that churn among FTSE 100 CEOs was 23 percent in 2013/14, up from 14 percent the previous year and the highest since before the financial crisis began. For FTSE 100 FDs, this year’s churn and increase in churn was even higher: 24 percent up from 13 percent the preceding year. Indeed, according to KPMG’s analysis, in the last year, over half of the board rooms in the FTSE 100 experienced at least one change of executive director, the highest proportion in the last five years.

FTSE100 Board Changes from 2008 to 2014

The years covered in the chart above are from May to April. Therefore 13 / 14 is companies with a year end in May 13 to those with a year end in April 14

According to David Ellis, head of reward services at KPMG in the UK, these high levels of churn beg the question of whether long term pay remains meaningful. He comments: “Does it really make sense for companies to put pay structures in place that run for, say, five years, if churn is running at over 20 percent? If this level of turbulence applies consistently across the FTSE100, no chief exec would be still in post after five years. Of course the reality is that there is some variance across the sample but even so, these high churn rates do beg the question of what is the most appropriate time horizon over which to structure a meaningful incentive package.”

David Ellis continues: “Companies have rightly been focussing on linking pay to long term corporate success. It is not that we think this focus is misplaced – but perhaps that the current rate of CEO churn creates a different problem for remuneration committees to grapple with.

“Our research suggests that it is equally likely that the terms on which a new CEO is appointed, or the policy applied when a director leaves, will be a major determinant of pay outcomes in any year. These terms – which are often couched in discretion to provide the all-important room to negotiate -should be crafted with the same care and attention as the performance conditions which govern how much an individual would be paid for delivering real value to shareholders.”

Click here to download the KPMG Guide to Directors Remuneration - 2014 Summary.

About KPMG

KPMG LLP, a UK limited liability partnership, operates from 22 offices across the UK with approximately 11,500 partners and staff. The UK firm recorded a turnover of £1.8 billion in the year ended September 2013. KPMG is a global network of professional firms providing Audit, Tax, and Advisory services. It operates in 155 countries and has 155,000 professionals working in member firms around the world. The independent member firms of the KPMG network are affiliated with KPMG International Cooperative ("KPMG International"), a Swiss entity. Each KPMG firm is a legally distinct and separate entity and describes itself as such.